Credit note

A credit note is a document issued when it is necessary to adjust an original commercial invoice. This may occur for several reasons, such as product returns, discounts that were not initially applied, or errors in the original invoice.

This type of document has important operational and financial implications:

Accounting impact

A credit note affects accounts payable by reducing the total amount owed to the supplier, since it adjusts the original invoiced value.Customs and import impact (before nationalization)

If the products have not yet been nationalized, a credit note may impact the preparation of the Import Declaration (DIM).

For example, when a supplier issues a credit note for products that are still in a Free Trade Zone, it is still possible to adjust customs duties, taxes, and other charges, as these calculations are based on the declared value.Costing and liquidation impact

Credit notes also affect the final cost calculation, since product costing is based on both the quantities and the total value of the complete logistics operation. Any adjustment to the invoice value directly impacts the final cost per product.

How to upload a Credit Note to a shipment

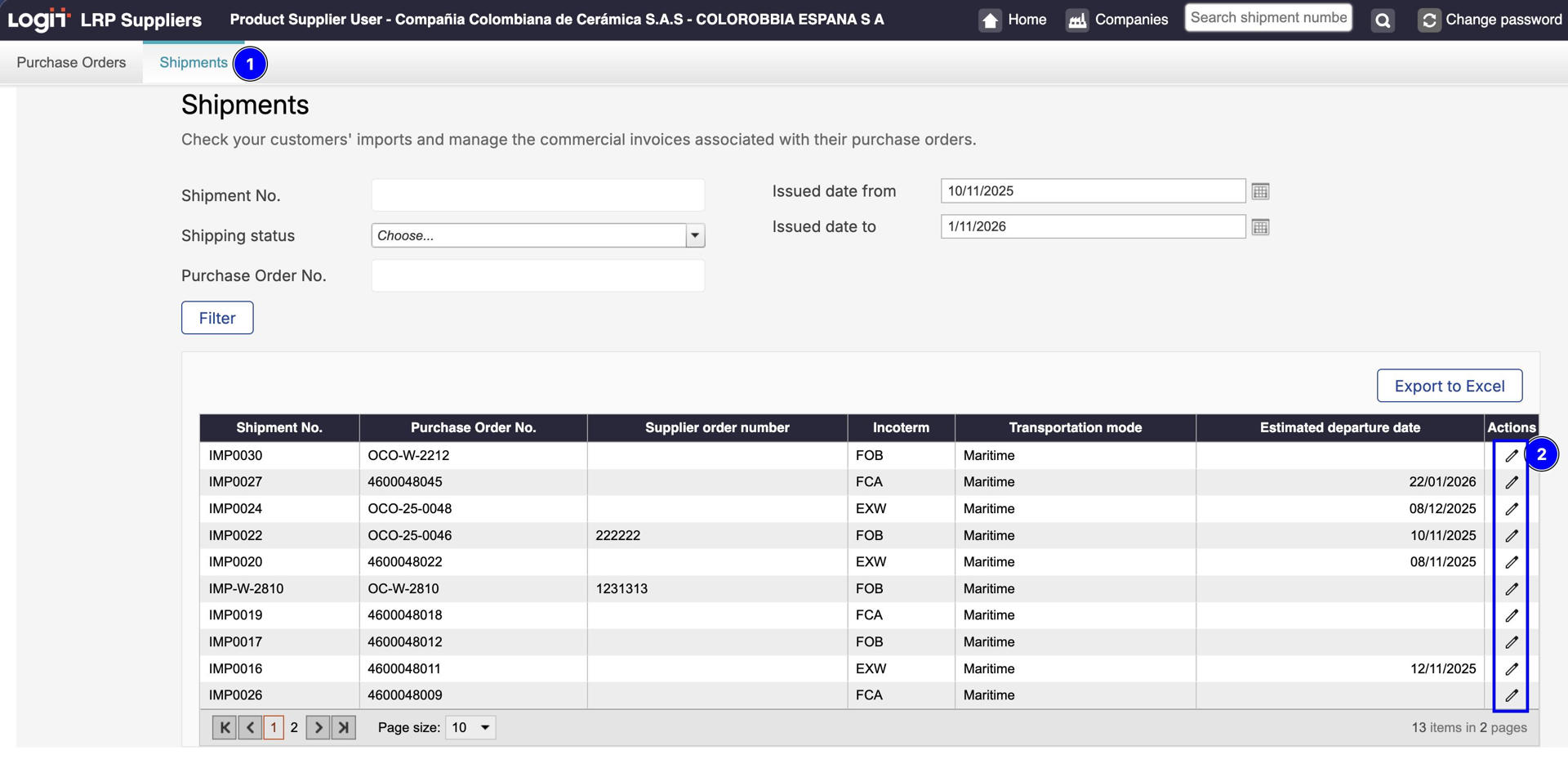

Go to Shipments from the main menu.

In this view, you will see all shipments associated with the purchase orders that include the shipped products.In the Actions column, click the Edit icon of the shipment you want to manage to open its detail view.

Edit shipment

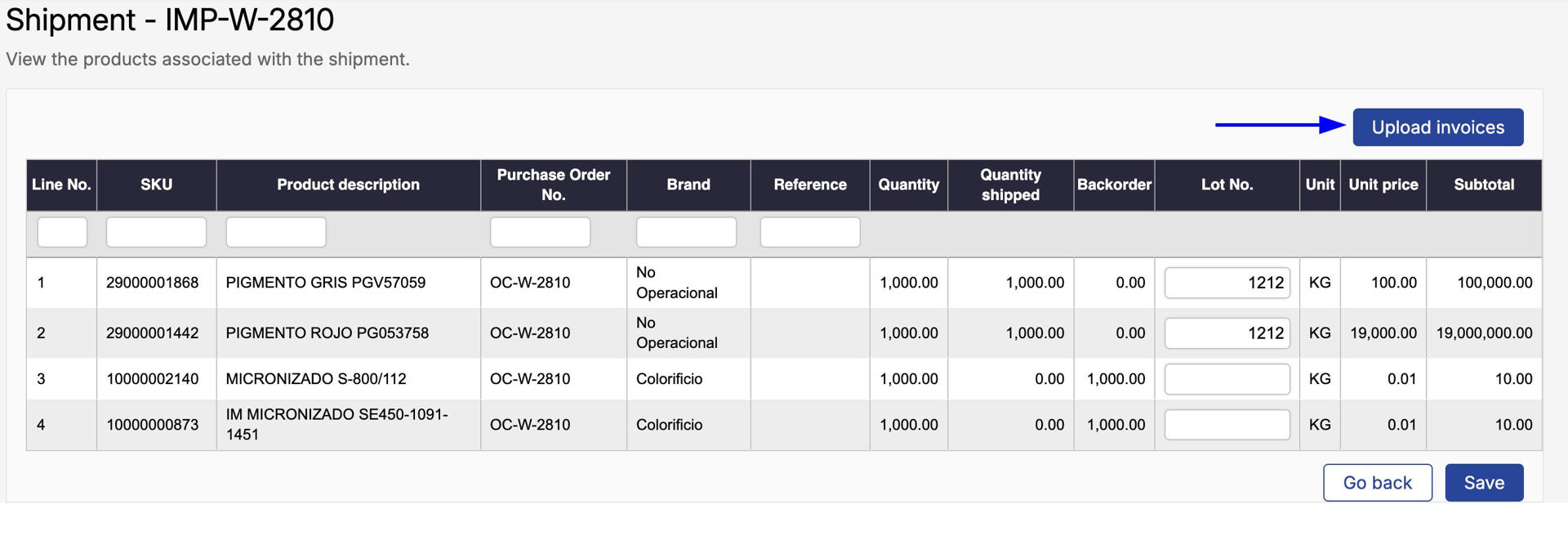

In the shipment detail screen, you will see a table with the shipped products.

To add a Credit Note, click Upload invoices.

Upload invoices action

A new window will open showing the Commercial documents already registered for the selected shipment.

Click New document

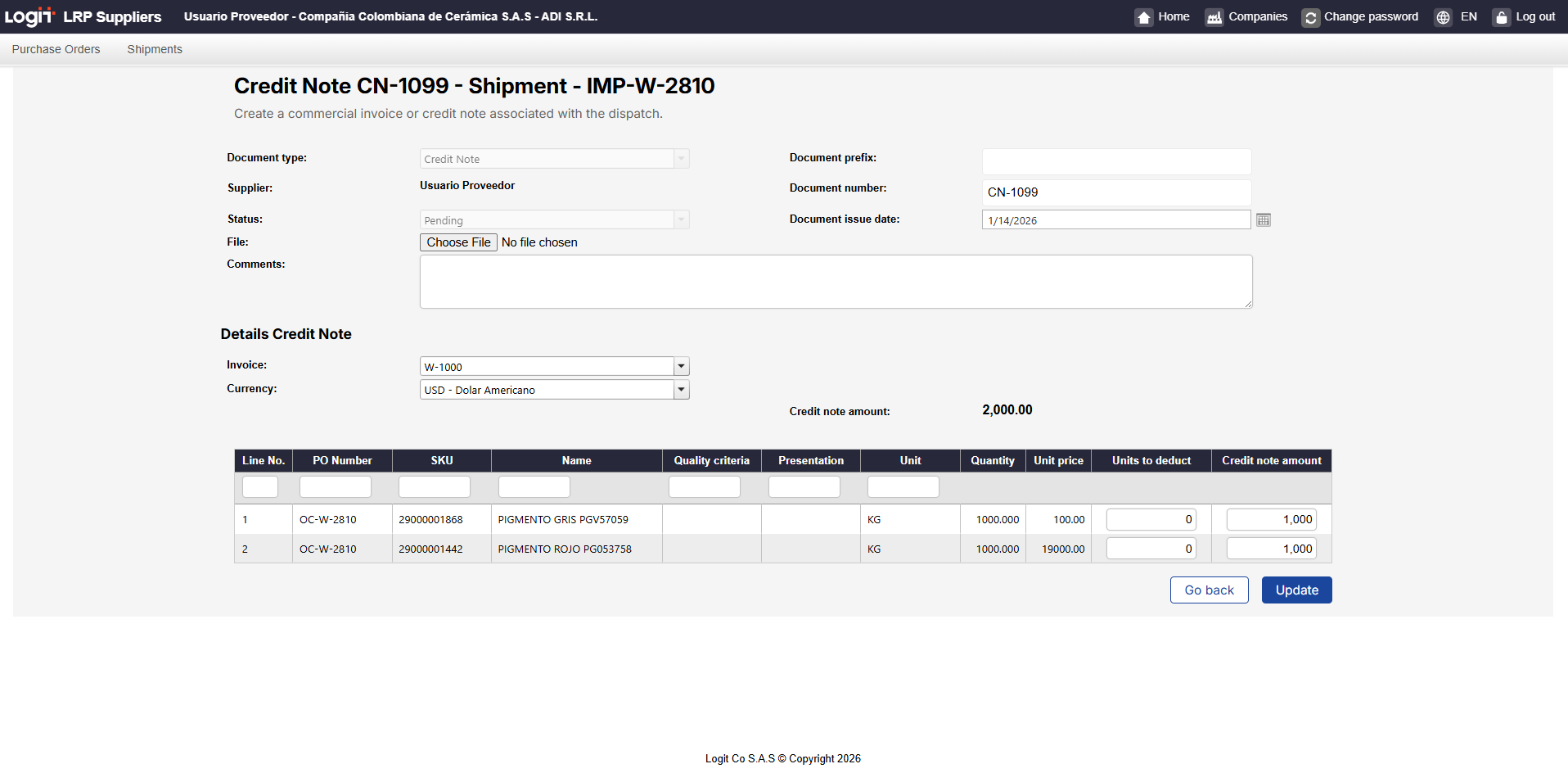

Select the document type Credit Note and complete the required information.

Click update to finish.

Once uploaded, the Credit Note will be associated with the shipment and will be available to the client for their logistics, customs, and cost processes.

Credit Note - Field definitions

Document type: Defines the type of commercial document:

Invoice CxP (Commercial Invoice)

Credit Note (used in this case)

Supplier: Displays the supplier associated with the shipment.

Pre-filled and not editable.Status: Shows the current status of the document (e.g., Pending).

File: Allows you to upload the commercial invoice file (PDF or supported format).

The uploaded file represents the official commercial invoice document.Comments: Optional field to add notes or clarifications related to the credit note.

Document prefix: Optional prefix used as part of the document reference, if applicable.

Document number (Required): The official commercial invoice number issued by the supplier.

This number must match the uploaded document.Document issue date: The date on which the commercial invoice was issued.

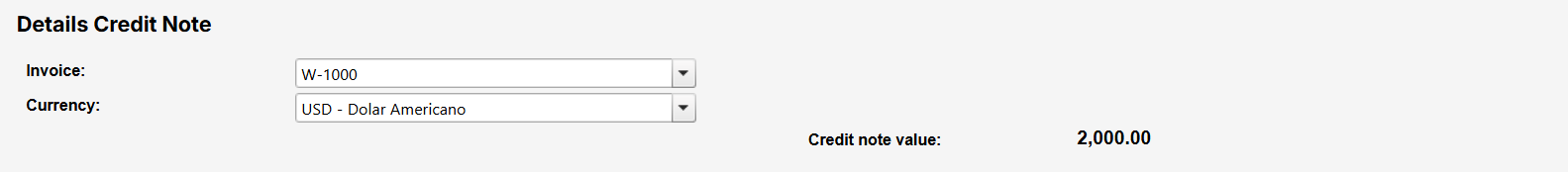

Details - Credit Note

Invoice: The original commercial invoice to which the credit note is associated.

Currency: The currency in which the credit note is issued.

This currency must match the currency of the associated invoice, as the credit note adjusts the invoice value in the same monetary unit.

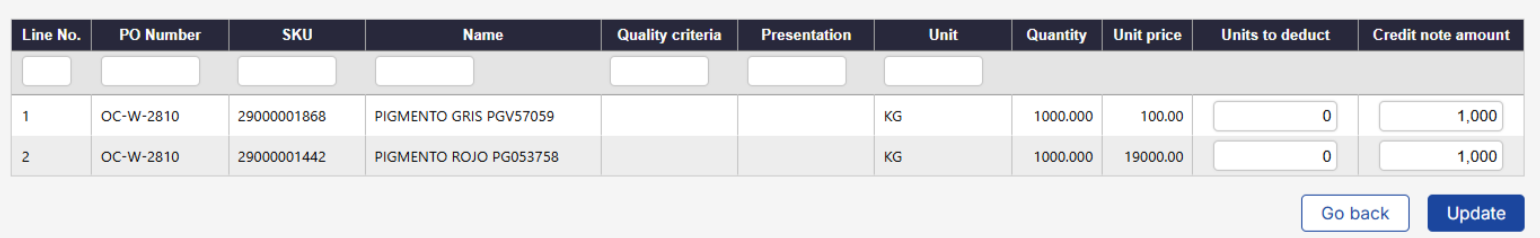

Table fields definitions

Line No.: Used to identify the position of each product within the table. For companies with system integrations, this field is also used to maintain data consistency across systems.

PO No.: Indicates the purchase order to which the SKU belongs.

SKU: The product reference code (Stock Keeping Unit) used to uniquely identify each product.

Name (description): The commercial name assigned to the product when it is created. This field can also be used to filter the table and quickly locate products.

Quality criteria: Some companies use additional criteria, beyond the SKU, to further describe a product. For example, color variations for products that share the same SKU.

Presentation: Describes how the product is packaged or presented for sale or transportation, depending on the case. For example, textiles may have a presentation such as “roll”.

Unit: Indicates the unit of measure used to count or weigh the product. Units may vary depending on the product type and can include kg, unit (u), package, etc.

Quantity: The quantity used for invoice calculations.

Unit price: Represents the price of a single unit of the product, expressed in the corresponding currency (e.g., USD, EUR).

Units to deduct: The quantity of products that are deducted through the credit note.

Credit note amount: The monetary amount issued in the credit note, expressed in the same currency as the original invoice.